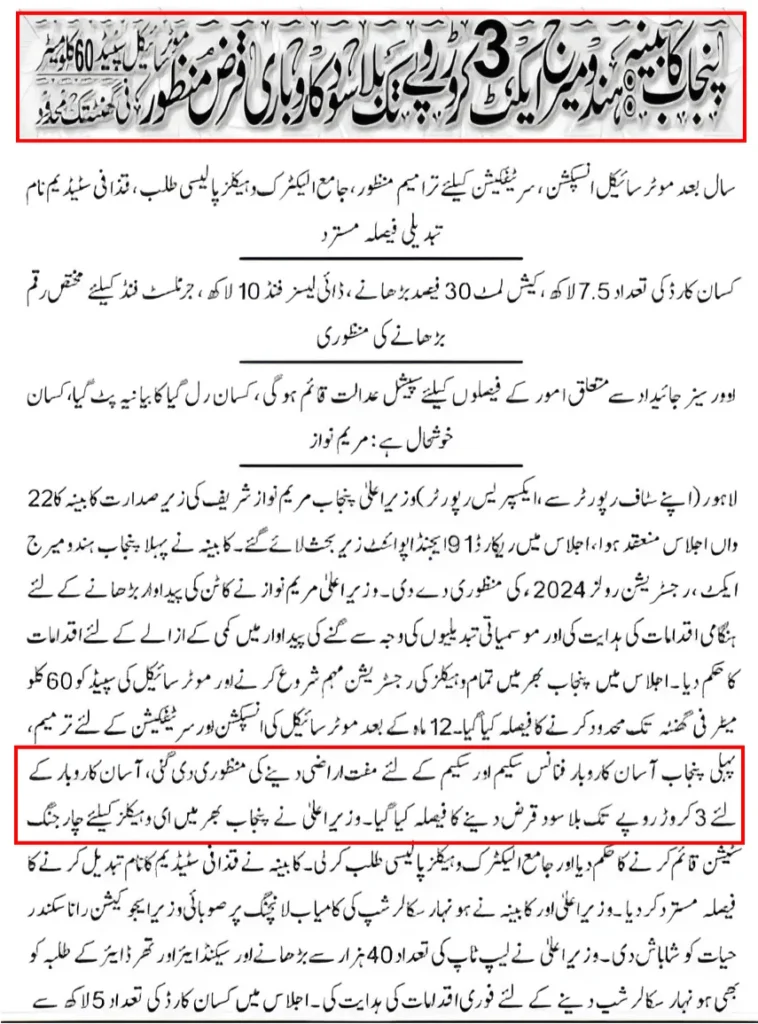

Asaan Karobar Finance Scheme (آسان کاروبار فنانس سکیم) – 2025

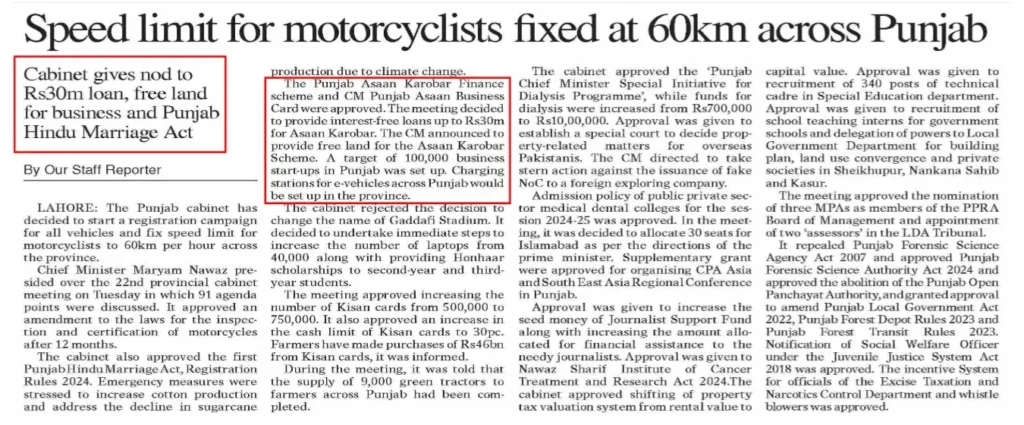

With Pakistan’s economy facing major challenges, the Punjab Government has launched a bold initiative to support local businesses and stimulate economic growth. The newly introduced Asaan Karobar Finance Scheme 2025 offers interest-free loans of up to Rs. 30 million to help entrepreneurs, small businesses, and start-ups take off without the burden of high financial costs.

This landmark program aims to create thousands of new jobs, uplift struggling communities, and empower youth and women-led businesses across Punjab. Backed by full government approval, the scheme offers a reliable opportunity for those seeking to expand or launch their own enterprise with official support.

If you’re an aspiring entrepreneur or an existing business owner in Punjab, this is your chance to access capital and build a sustainable future with zero-interest financing under the Asaan Karobar Finance Scheme.

Interest-Free Loan Scheme

Laon Amount Up to 30 Million

Up to 5 Years Loan Tenor

Easily Payable Installments

Easy Digitilized Processing

What is Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme, a revolutionary multi-million-rupee initiative, has been launched by the Government of Punjab to provide crucial support to entrepreneurs. This first-of-its-kind scheme is designed to offer interest-free loans of up to Rs. 30 million (Rs. 3 Crore), aimed at empowering business owners across Punjab. The program targets various sectors, including agriculture, small-medium enterprises (SMEs), and other growth-driven industries. Its primary objectives are to drive economic development, boost exports, and create employment opportunities in the region.

For individuals exploring financial assistance options, like the Asaan Karobar Finance Scheme, it’s equally important to stay updated on other government support programs. One such initiative is the Semakan STR, which allows eligible Malaysians to check their application status for the Sumbangan Tunai Rahmah (STR) aid. Staying informed about both entrepreneurial funding and direct financial aid can help beneficiaries make better financial decisions.

The Punjab Government has set an ambitious goal to establish 100,000 new start-ups throughout the province. To ensure the success of these ventures, the CM Punjab also directed that business plans be provided to these start-ups, ensuring they have the guidance and support needed for long-term growth and sustainability.

Additionally, CM Maryam Nawaz Sharif approved the introduction of the “Asaan Business Card” (or “Asaan Karobar Card”). This initiative aims to provide small businesses with interest-free loans of up to Rs. 1 million to support their business-related expenses, ensuring financial empowerment for entrepreneurs at all stages. facilitating small business owners by offering interest-free loans for business-related activities.

The 8171 web portal is linked where government aid schemes and financial eligibility checks are discussed, matching the user’s intent for financial assistance.

For those actively seeking employment in the public sector, explore the Latest Government Jobs in Pakistan a trusted source for verified listings, departmental recruitment updates, and career opportunities across all federal and provincial levels.

Source: Express New

Source: Dawn News

Objectives of the Asaan Karobar Finance Scheme

The Asaan Karobar Finance Scheme offers numerous benefits to entrepreneurs, helping them unlock opportunities and drive their businesses toward success. Below are some of the key advantages:

Note: By offering these valuable benefits, the Asaan Karobar Finance Scheme positions itself as a game-changer for entrepreneurs and business owners across Punjab, offering comprehensive support and ensuring sustainable growth for businesses of all sizes.

Alongside government programs like the Asaan Karobar Finance Scheme, digital platforms are becoming a popular way for individuals to earn from home. Many people, especially students and women, are now using trusted apps that offer flexible and reliable income opportunities without the need for a large investment.

One such platform is the 92pkr, which allows users to earn real money by completing simple tasks and referring friends. Similarly, J10 game provides fun and rewarding games with cash bonuses for active users. Another great option is Y999, which offers daily rewards, secure withdrawals, and a smooth user experience. These earning apps are opening new doors for financial growth in a digital world.

Discover the Latest Jobs in Pakistan through jobscentre.pk, a reliable platform for accessing up-to-date government and private sector career opportunities with direct online application options.

Looking for alternative ways to earn money online? Try your luck and skills with trusted platforms like P999 Game – a top-rated online casino where real money games offer both entertainment and potential income.

Some users also visit Teen Patti Crown to enjoy skill-based card games in a casual and engaging digital environment.

With the rising popularity of online betting sites in 2025, Bet939 has emerged as a trending destination for users interested in real-time betting and alternative earning opportunities.

Discover popular digital platforms like B9 Game where fun meets potential rewards.

Enjoy secure gameplay and real rewards with 3 Patti OK, a trusted online card gaming platform designed for seamless user experience.

Benefits of Asaan Karobar Finance Scheme

Additional Incentives

In today’s digital age, many users explore gaming platforms for side income. Pak Super Game stands out as a reliable and engaging option for those seeking fun and earnings together through online gameplay.

For a smooth and rewarding card gaming experience, 3 Patti Boss offers secure play, real cash prizes, and user-friendly features trusted by online players.

Some individuals also explore WinPKR for interactive digital games, enjoying light recreation alongside their daily routines.

For light entertainment during free time, some users visit platforms like Td777 to explore simple card games and digital gaming experiences.

Explore entertainment-based earning options like S9 Game for a chance to play and win online.

The basant club is linked where local business networking and community growth are highlighted, matching the entrepreneurial theme.

Eligibility Criteria for Asaan Karobar Finance Scheme

The Asaan Karobar Finance Scheme is structured into two distinct tiers, designed to cater to businesses of different sizes and financial needs. These tiers provide flexibility in loan amounts, ensuring that a wide range of entrepreneurs can benefit from this initiative.

Tier-1: Unsecured Loan up to Rs. 5 Million

In Tier-1, applicants can access unsecured loans of up to Rs. 5 million. These loans require personal guarantees from the applicants but do not require additional collateral. This is ideal for small businesses or start-ups that may not have significant assets but require capital to grow or expand.

Tier-2: Secured Loan from Rs. 5 Million to Rs. 30 Million

Tier-2 offers secured loans, ranging from Rs. 5 million to Rs. 30 million. To access this tier, applicants must provide collateral, such as property or other secured assets. This tier is suitable for businesses looking to scale significantly or expand their operations, with larger funding requirements.

Eligibility Criteria for Application:

To qualify for the Asaan Karobar Finance Scheme, applicants must meet the following criteria:

Explore secure communication tools like GB WhatsApp for better connectivity alongside your business journey.

Platforms like B9 Game offer users a digital space for casual engagement, combining entertainment with accessible gameplay experiences.

Among the most talked-about platforms in 2025 for secure online gaming and earning, Lucky 91 offers users a seamless experience with real rewards, making it a popular choice for digital income seekers.

Platforms like 92 Jeeto offer casual users a digital space for interactive games and light entertainment during their downtime.

Stay up to date with online platforms such as Betpkr offering digital gaming and real-time opportunities.

Loan Details

The Asaan Karobar Finance Scheme offers two loan tiers, each with its own set of benefits and eligibility requirements, designed to meet the varying needs of entrepreneurs.

Tier-1 (T1): Unsecured Loan – Up to Rs. 5 Million

Tier-1 is ideal for small businesses and start-ups that need financial support but may not have significant assets to secure a loan. The unsecured loan option makes it easier for entrepreneurs to access funding without the need for collateral.

Tier-2 (T2): Secured Loan – Rs. 6 Million to Rs. 30 Million

Tier-2 is intended for businesses looking to expand significantly or for those requiring a higher loan amount. This option is secured, meaning applicants must offer collateral (such as property or assets) to back the loan.

Note: The grace period is up to 6 months for start-ups/ for the new businesses and up to 3 months for the existing businesses..

Equity Contribution

Additional Costs

Repayment Terms

Experience smooth performance and real money gaming on Royal X Casino, a top mobile casino app with reliable payouts.

Platforms like Teen Patti Boss provide entertainment-focused users with accessible online card gameplay during their free time.

If you are also interested in the latest gaming and entertainment trends, check out Noob Win Game for engaging updates and opportunities.

Others prefer different platforms such as 777cx for online income opportunities.

Many users also explore S9 Game for engaging online experiences that combine entertainment with gameplay rewards.

As online gaming continues to evolve into a legitimate source of side income, platforms like B9 are setting a new standard by combining secure gameplay with consistent earning potential making it a trusted choice for users looking to balance entertainment and extra income in 2025.

Some individuals explore alternative online ventures like 777cx and 777FE Game Download for earning.

Some users also explore digital platforms like 92 glory for casual gaming and online entertainment alongside their daily routines.

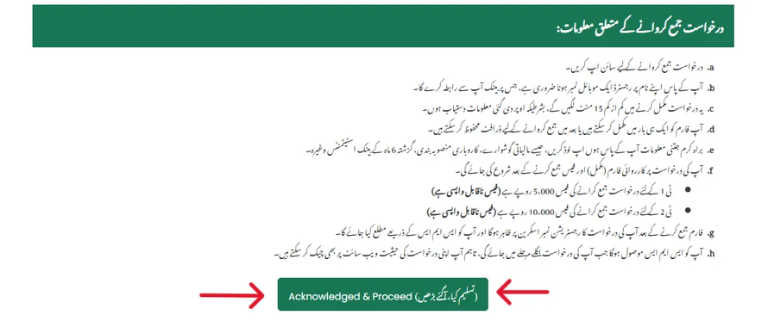

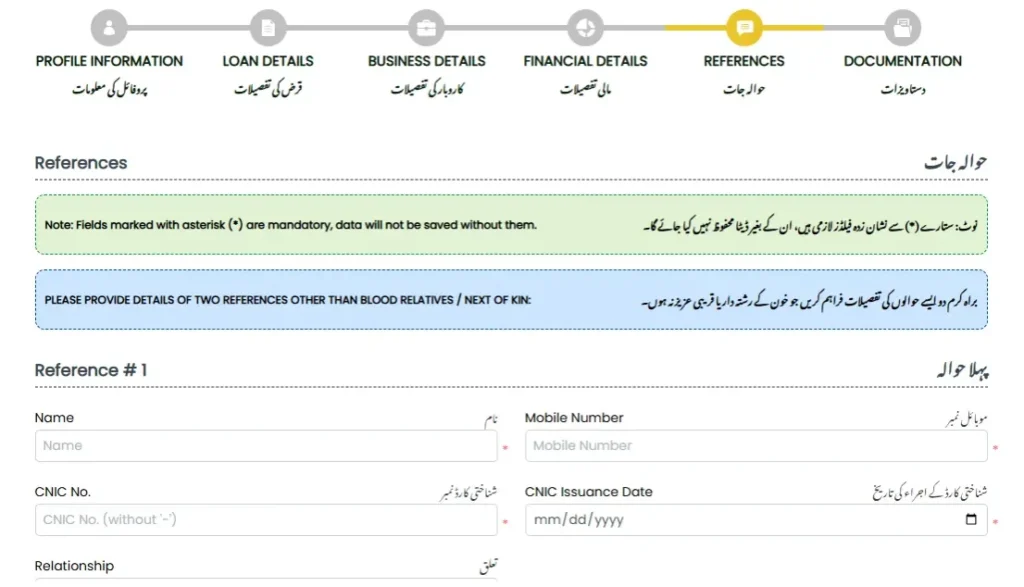

Asaan Karobar Finance Scheme Apply Online

Step 01: Start the Application

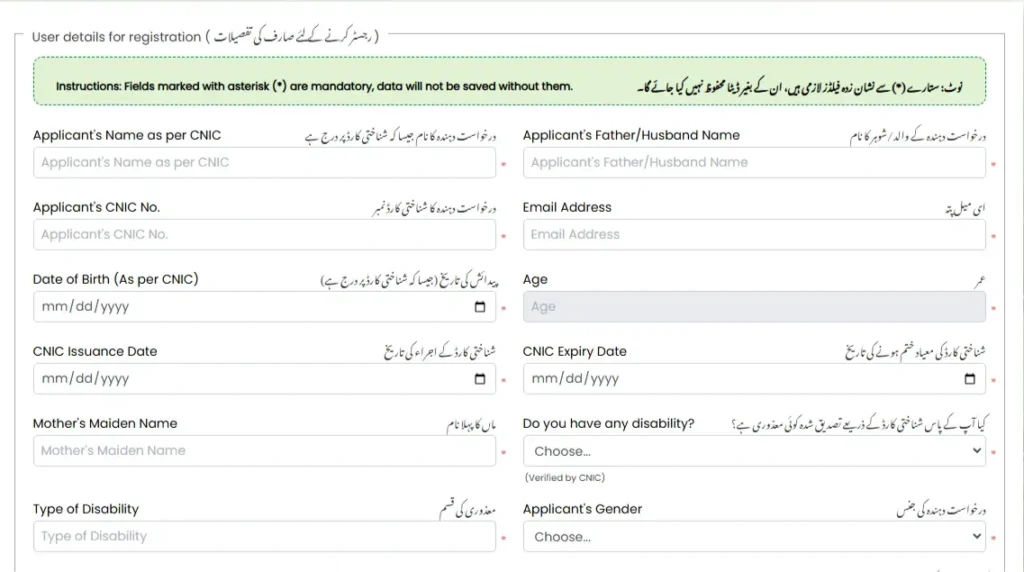

Step 02: Profile Information

Note: Please double-check your personal information before submitting, as it cannot be changed after registration.

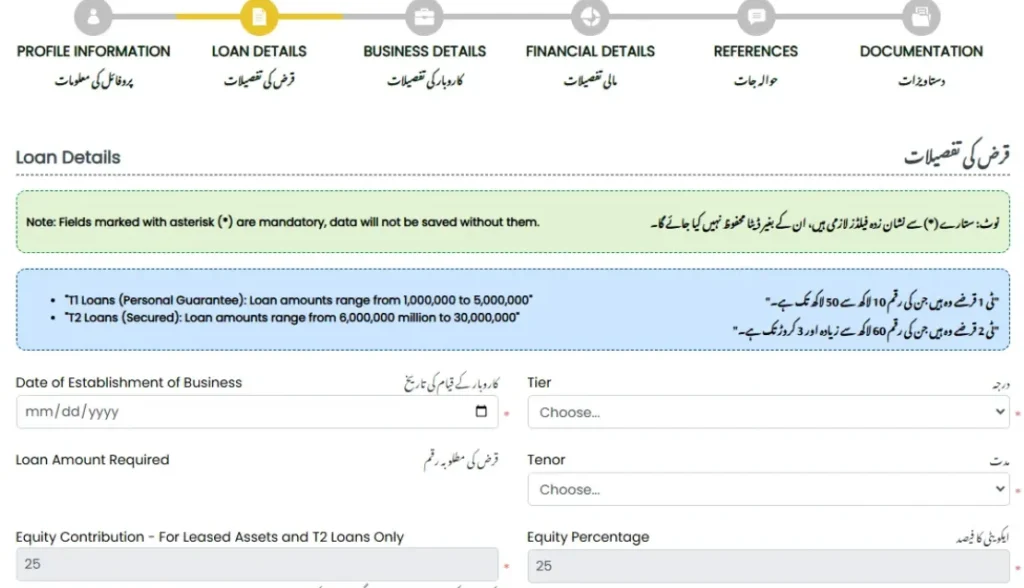

Step 03: Loan Details

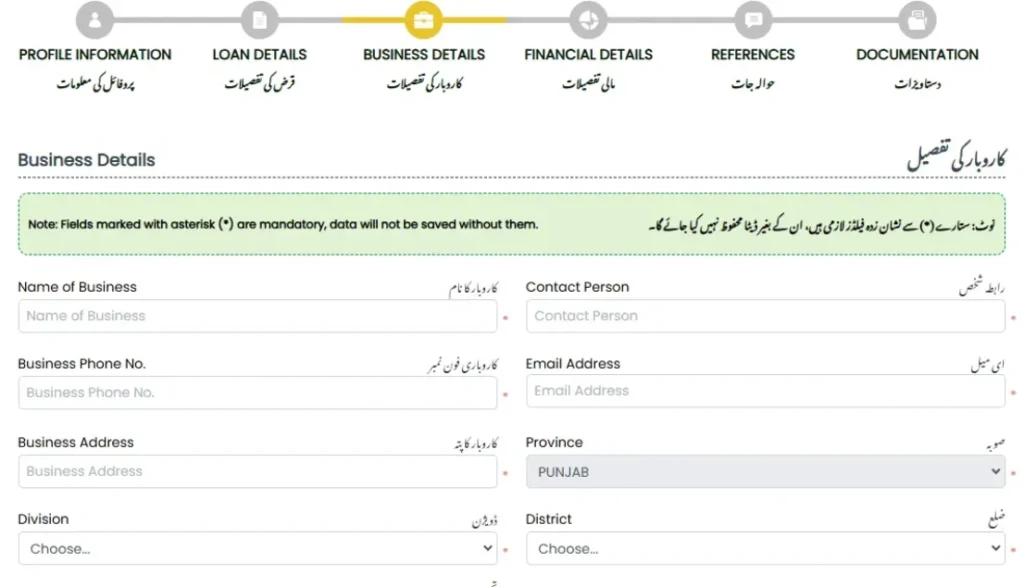

Step 04: Business Details

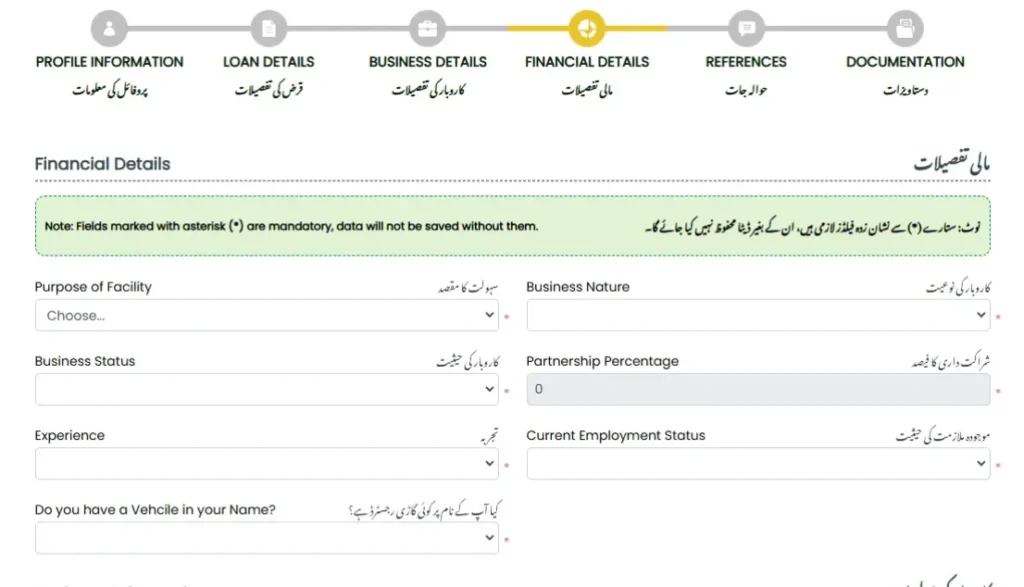

Step 05: Financial Details

Step 06: References

Step 07: Documentation

More About the Asaan Karobar Finance Scheme

The Government of Punjab is set to expand the Asaan Karobar Finance Scheme with the launch of Phase II in the fiscal year 2025-26. This new phase will have a significantly larger scope, with a funding pool of up to Rs. 100 billion, designed to support a total of 24,000 small and medium enterprises (SMEs) across the province.

With Rs. 379 billion allocated for loan disbursement, this phase aims to provide even greater financial support to entrepreneurs and business owners in a variety of sectors, further contributing to economic growth, job creation, and business expansion throughout Punjab.

Helpline Number

Also Check: How to “Submit a Complaint for Asaan Karobar Finance Scheme.”

Asaan Karobar Card (Asaan Business Card)

The Government of Punjab has introduced the Asaan Karobar Card (also known as the Asaan Business Card) to support small entrepreneurs throughout the province. This initiative offers interest-free loans of up to Rs. 1 million for a period of three years, providing critical financial assistance for business growth.

To ensure efficient fund usage, the allocated funds will be distributed through digital platforms, enabling entrepreneurs to easily access and manage their financial resources for business-related activities.

The program aims to benefit over 100,000 small businesses across Punjab, helping them thrive and contribute to the economic development of the region.

This transformative initiative has been spearheaded by Chief Minister Maryam Nawaz Sharif as part of her broader economic reform package aimed at strengthening Punjab’s economy and enhancing the financial well-being of its residents. The program is designed not only to support entrepreneurs but also to foster improvements in housing, agriculture, and the renewable energy sector, driving sustainable development across the province.

Frequently Asked Questions

-

How much loan should I get, and is it interest-free?

The Asaan Karobar Finance Scheme offers loans of up to Rs. 30 million to entrepreneurs in various sectors, including agriculture. The primary goal is to support new businesses and strengthen existing ones across Punjab. Importantly, the loan is interest-free, ensuring that businesses can grow without the financial burden of interest payments.

-

What are the objectives of the Punjab Asaan Karobar Scheme?

The Asaan Karobar Scheme aims to achieve several key objectives to support entrepreneurship and economic growth in Punjab:

Strengthen the province’s economy by promoting business development and job creation.

Provide business opportunities to entrepreneurs, helping them establish and expand their ventures.

Boost exports and create job opportunities, contributing to the overall growth of the province.

Support new and existing businesses by offering financial aid and resources for expansion and modernization. -

What are the eligibility criteria for the Asaan Karobar Scheme?

While the official eligibility criteria are yet to be formally announced, based on available information, the following requirements are expected:

Age: Applicants must be between 25 to 55 years old.

Credit History: A clean credit history is required for eligibility.

Business Premises: Applicants must own or lease a business premises.

Repayment Period: The loan repayment period is expected to be five years. -

What is the last date to apply for the Asaan Karobar Finance Scheme?

The Government of Punjab has not yet officially announced a last date for applications. However, the scheme is expected to be ongoing, providing continuous support to young entrepreneurs in the future.

-

What is the age limit to apply for this scheme?

To apply for the Asaan Karobar Finance Scheme, applicants must be between 25 and 55 years old at the time of application.

-

What is the helpline number of the Asaan Karobar Finance Scheme?

The helpline number for the Asaan Karobar Finance Scheme in Punjab is 1786. You can call this toll-free number anytime for assistance related to the scheme.

-

How can I check my application status?

You can easily check your application status by logging into your portal. Simply provide your application number or tracking number when prompted. For further assistance, you can follow the step-by-step guide available on the portal.

Conclusion

The Asaan Karobar Finance Scheme is a game-changing initiative introduced by the Government of Punjab, Pakistan, to empower entrepreneurs and foster business growth across the province. With interest-free loans of up to 30 million PKR, the scheme aims to help both start-ups and existing businesses expand, modernize, and thrive.

By offering affordable financial support, the scheme is designed to drive economic growth, create job opportunities, and contribute to the development of businesses in various sectors. The eligibility criteria are straightforward, making it accessible for a wide range of entrepreneurs looking to make a significant impact.

Stay updated for the official application announcement and don’t miss out on this valuable opportunity. If you have any questions or need assistance, feel free to contact us.