Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) – 2025

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS), launched by the Government of Pakistan, is a groundbreaking initiative aimed at empowering the youth of Pakistan. This program provides affordable loans with easy terms and conditions, enabling young entrepreneurs to start new businesses or expand existing ventures in the SME and agriculture sectors.

By offering low-interest loans and flexible repayment options, the scheme is designed to foster entrepreneurial growth and contribute to the economic development of the country. The PMYB&ALS not only supports individuals looking to launch their businesses but also helps those seeking to modernize and scale their existing operations.

What is the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)?

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS) is an initiative by the Government of Pakistan designed to support young individuals in launching their businesses or expanding existing ventures. This program aims to provide financial assistance to youth by offering affordable loans with simple terms and minimal markup.

The primary goal of the scheme is to empower young entrepreneurs by fostering innovation, stimulating the SME (Small and Medium Enterprises) sector, and enhancing the Agriculture industry. By partnering with multiple Islamic, Commercial, and SME banks, the scheme ensures easy access to financial resources, making it possible for youth to pursue their business dreams with minimal financial barriers. With low interest rates or no markup loans, the PMYB&ALS presents a unique opportunity for young people to explore entrepreneurial opportunities and make meaningful contributions to Pakistan’s economy.

Objectives of the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS) aims to foster a thriving entrepreneurial ecosystem in Pakistan by achieving the following key objectives:

Benefits of the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)

By providing affordable financing and favorable terms, the scheme makes it easier for youth entrepreneurs to pursue their business goals while contributing to the country’s economic development.

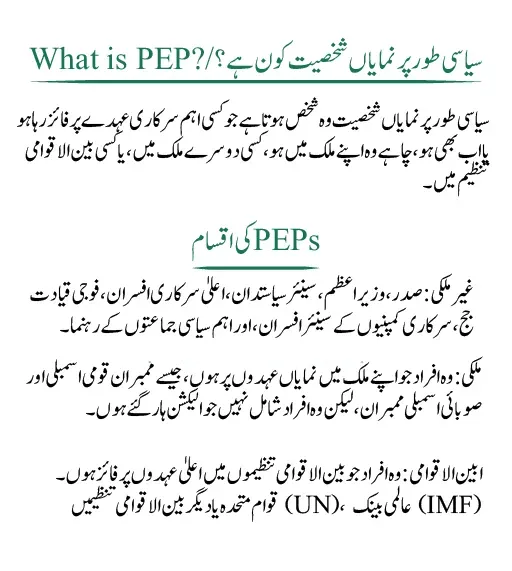

Eligibility Criteria for PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)

The PM Youth Business and Agriculture Loan Scheme (PMYB&ALS) is designed to support youth entrepreneurs and farmers across Pakistan. To qualify for this scheme, applicants must meet the following eligibility criteria:

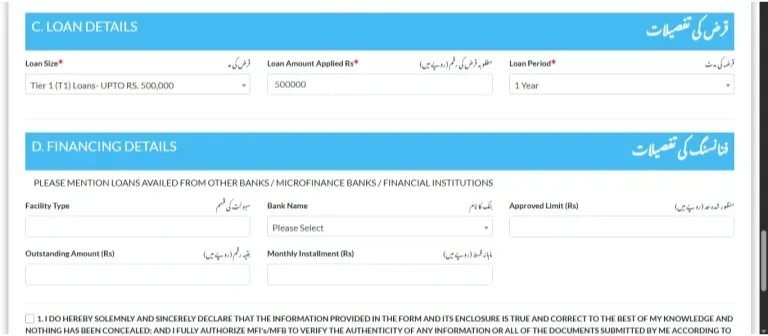

Loan Details

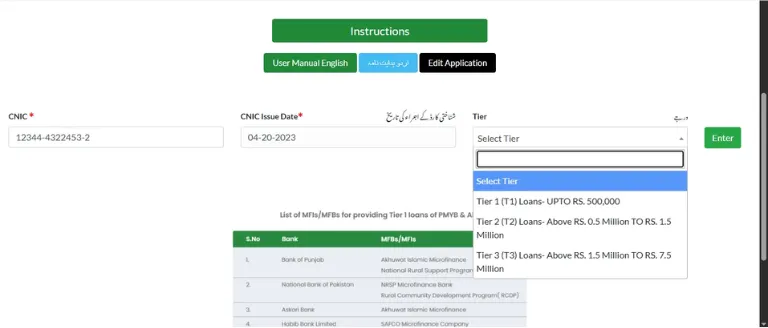

The Prime Minister’s Youth Business & Agriculture Loan Scheme offers loans in three tiers, designed to cater to businesses of various sizes and financial needs. Below are the details of each loan tier:

Tier 1

Tier 2

Tier 3

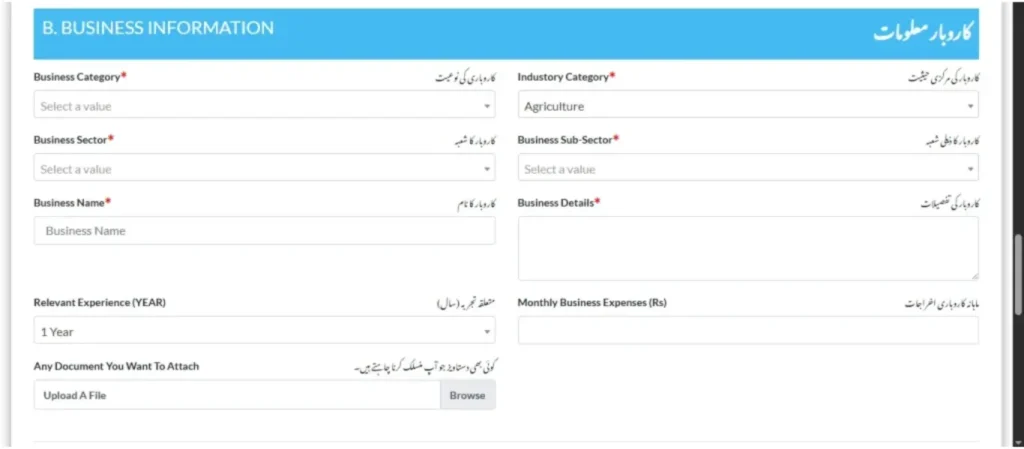

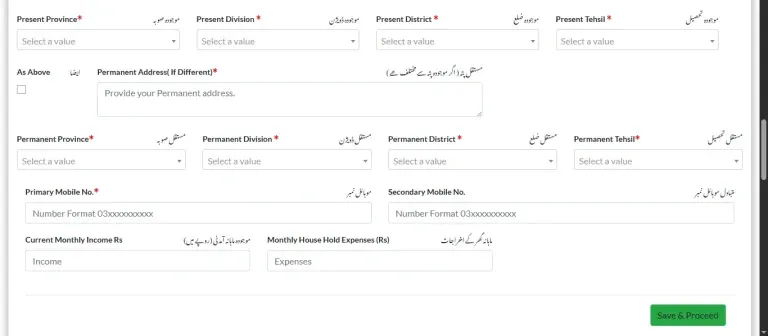

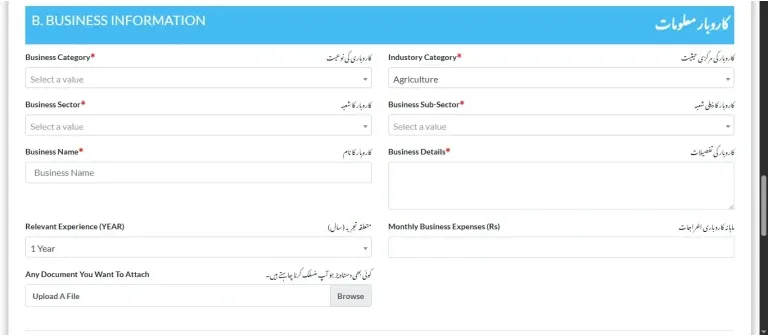

How to Apply for the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)

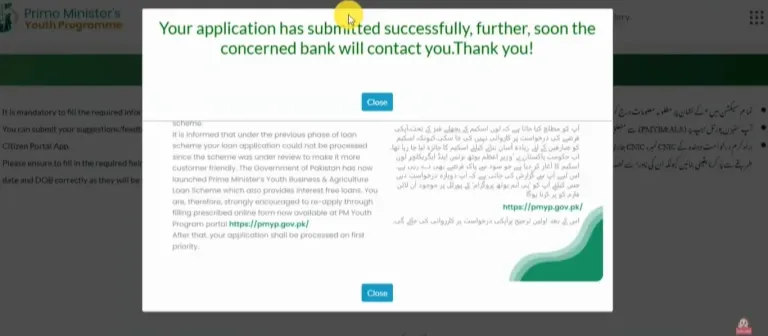

The PM Youth Business and Agriculture Loan Scheme is designed to be accessible, with a completely online application process for ease and convenience. Follow this step-by-step guide to apply for the loan:

Important Instructions Regarding the Application for the PM Youth Business and Agriculture Loan Scheme

Check Your Application Status for PM Youth Business & Agriculture Loan Scheme (PMYB&ALS)

After successfully submitting your application, you can easily check its status later. Follow these steps to track your application:

Loan Repayment Calculator

The Loan Repayment Calculator helps you calculate your loan repayment schedule for the Prime Minister’s Youth Business & Agriculture Loan Scheme. To access the calculator, simply click the button below.

Frequently Asked Questions

Conclusion

The PM Youth Business and Agriculture Loan Scheme is a vital initiative launched by the Prime Minister of Pakistan to provide accessible loans to young entrepreneurs. The primary goal of this scheme is to assist youth in establishing new businesses or modernizing and expanding their existing ventures. By empowering the next generation of entrepreneurs, this scheme will contribute to boosting Pakistan’s economy.

Through this program, young entrepreneurs can access loans of up to 7.5 million PKR. The loan scheme is divided into three tiers: Tier 1, Tier 2, and Tier 3. Before applying for any tier, please make sure to carefully read the instructions. A complete step-by-step process has been provided above to guide you through the application for the Prime Minister’s loan scheme.

![Punjab Socio-Economic Registration [New Survey] رجسٹر کریں 8 Pser Servey](https://cmp-punjab.com.pk/wp-content/uploads/2025/04/x_11zon.webp)

![PSER Registration Requirements for Individuals [Update] 2025 9 PSER-Registration-online](https://cmp-punjab.com.pk/wp-content/uploads/2025/05/cmp-punjab.com_.pk_11zon-1024x576.webp)