How to Apply for Tier 2 – PM Youth Business & Agriculture Loan Scheme (PMYB&ALS)

Are you planning to apply for a loan between Rs. 500,000 and Rs. 1.5 million (5 to 15 lacs)? The Tier 2 category of the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS) is designed exactly for that purpose. To help you get started, we’ve outlined the complete step-by-step application process below. But before you begin, make sure you’ve prepared all the required documents listed further down on this page.

Rs. 0.5-1.5 Million

5% Markup

Tenure: 08 Years

Required Documents for Tier 2 PM Youth Business & Agriculture Loan Application

Before starting your application, make sure you have the following documents ready. These are mandatory for a smooth and successful application under Tier 2 of the PM Youth Business and Agriculture Loan Scheme:

✅ Note: These documents should be kept ready before you begin the application process. Additional details will be requested in relevant sections during the online application.

How to Apply for Tier 2 – PM Youth Business & Agriculture Loan Scheme (PMYB&ALS)

The following step-by-step process is specifically for applicants interested in Tier 2 of the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS).

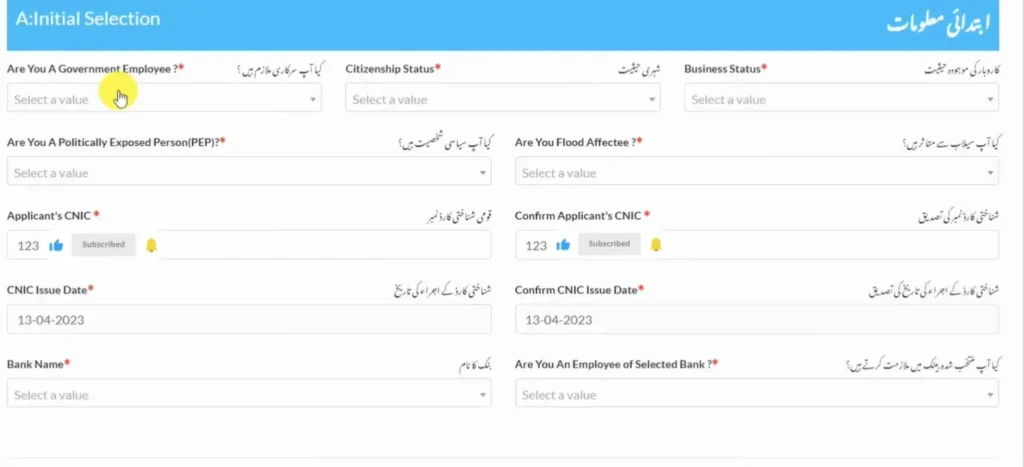

Step 01: Initial Selection

In this step, you will need to provide your basic information, including:

Next, enter your CNIC details and select the bank you wish to use for your PM Youth and Agriculture Loan.

Finally, choose your employment status with the bank.

Once all fields are completed, click “Submit and Next” to proceed to the next step.

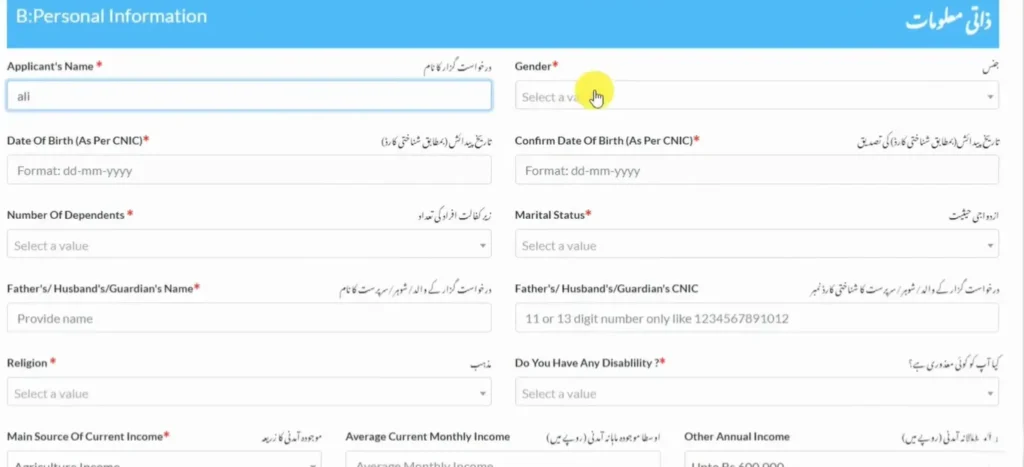

Step 02: Personal Information

In this step, you will need to provide the following personal information:

Next, you will enter details about your income, bank account, utility bill, consumer ID, and national tax number.

Finally, upload images of yourself along with your CNIC pictures (both front and back).

Once you’ve completed these details, click “Submit and Next” to proceed.

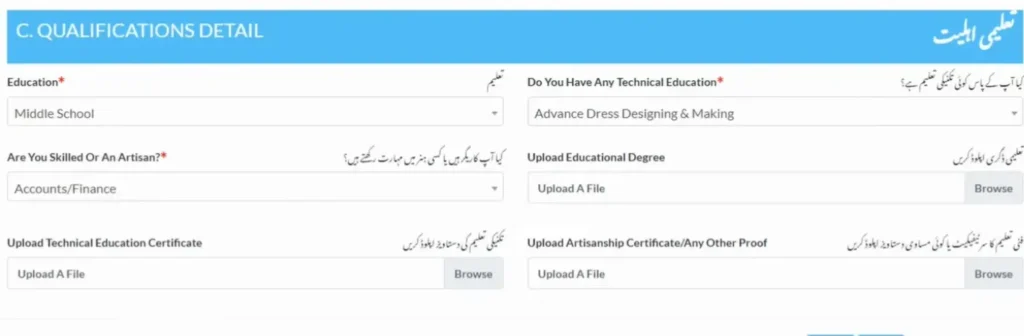

Step 03: Qualification Details

In this step, you will provide information about your:

After that, upload the relevant documents that support your educational qualifications.

Once done, click “Submit and Next” to proceed.

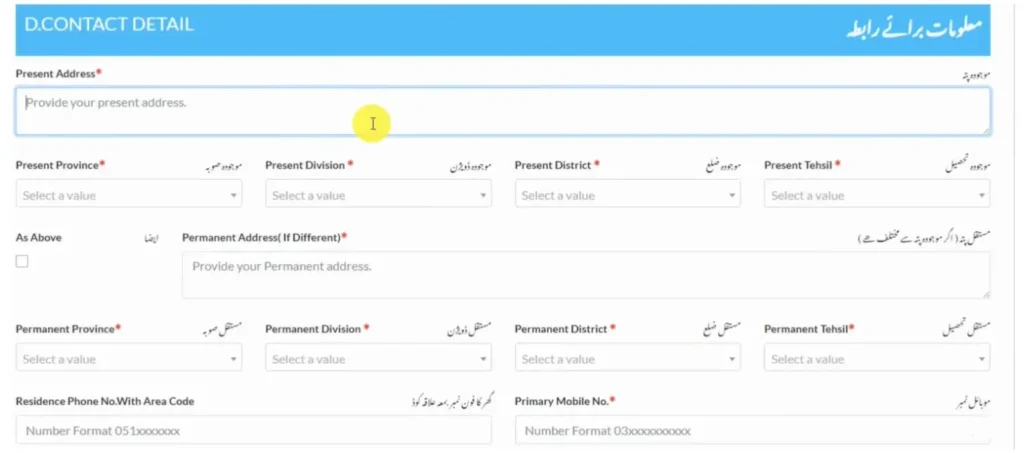

Step 04: Contact Details

In this section, you will need to provide:

Additionally, enter your mobile number, SIM owner details, and information about your residency type.

Once you’ve saved your information, click “Submit and Next” to proceed to the next section.

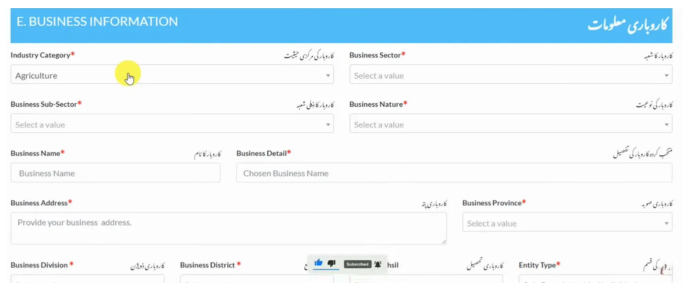

Step 05: Business Information

In this step, provide details about the business for which you’re applying for the loan, including:

Next, select your business registration status, business utility bill consumer ID, and business national tax number.

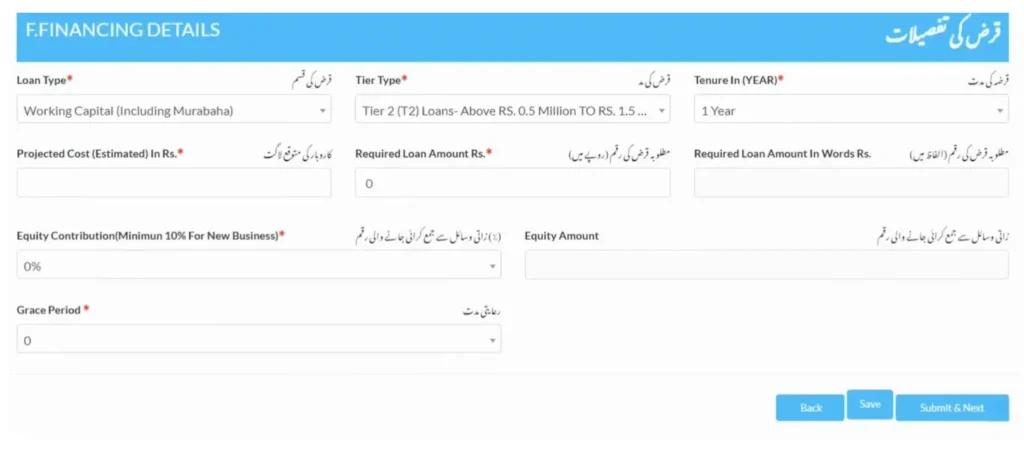

Step 06: Financing Details

In this section, provide the following details about your loan:

Once you’ve entered all the details, click “Submit and Next” to proceed.

Step 07: Business Plan

In this section, you will need to provide details about the business plan for which you are applying for the loan, including:

Lastly, upload your documents of experience and any other necessary documents.

Once completed, click “Submit and Next” to proceed to the next section.

Step 08: Financing History

In this section, you will provide details about any loans that your father or spouse has availed.

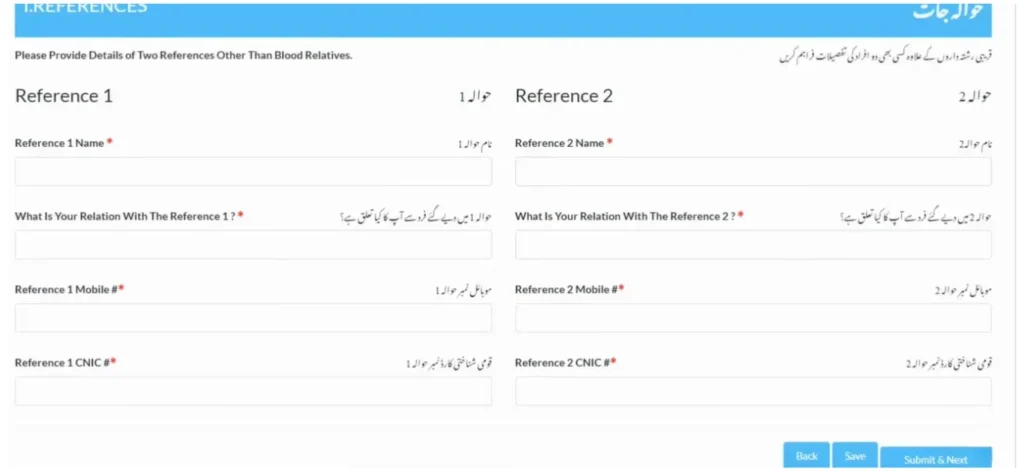

Step 09: References

In this section, you will need to provide details of two references. Please note that these references must not be your blood relatives.

For each reference, provide the following information:

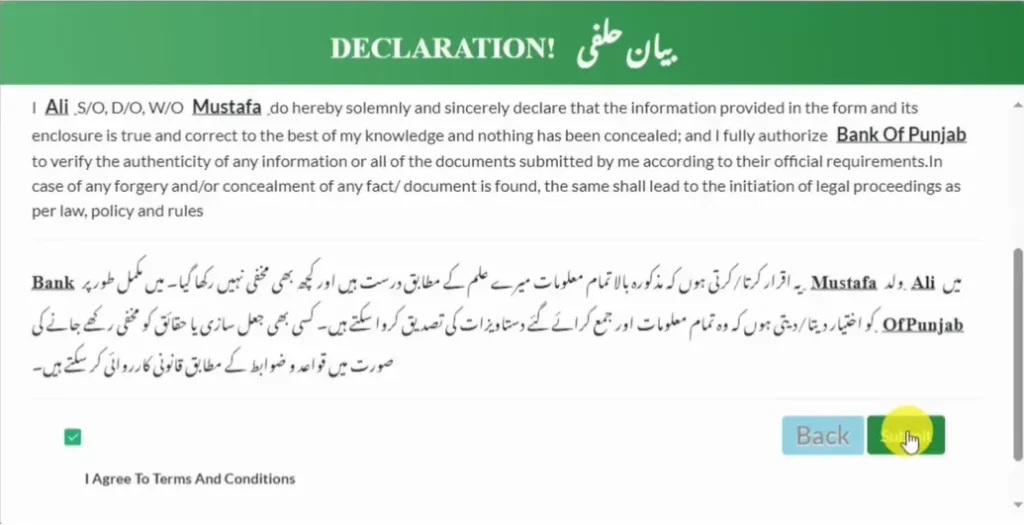

After entering the reference details, click “Save and Next”. A declaration certificate will appear.

Enter your CNIC, date of birth, and mobile number, check the “Terms and Conditions” box, and click “Submit” to successfully submit your application.

Note:

After submitting your application, you will receive further notifications from the bank you selected.

You can also track your application by clicking the button below.

Check Your Application Status for PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)

Once your application has been successfully submitted, you can check your application status later. To do so:

Loan Repayment Calculator

The Loan Repayment Calculator is designed to help you understand your loan payments under the Prime Minister’s Youth Business and Agriculture Loan Scheme.

Click the button below to access the calculator and calculate your loan repayments.

Frequently Asked Questions

Conclusion

You can apply for the Tier 2 PM Youth Business and Agriculture Loan Scheme if you’re looking to receive a loan ranging from 0.5 million to 1.5 million PKR. The markup rate for Tier 2 is 5%.

You can follow the complete step-by-step application process provided above. Additionally, you can check your application status and calculate your loan repayments/installments using the tools above.